Apr 28 | 2020

(Americas) Data Shows Drop By More Than Half

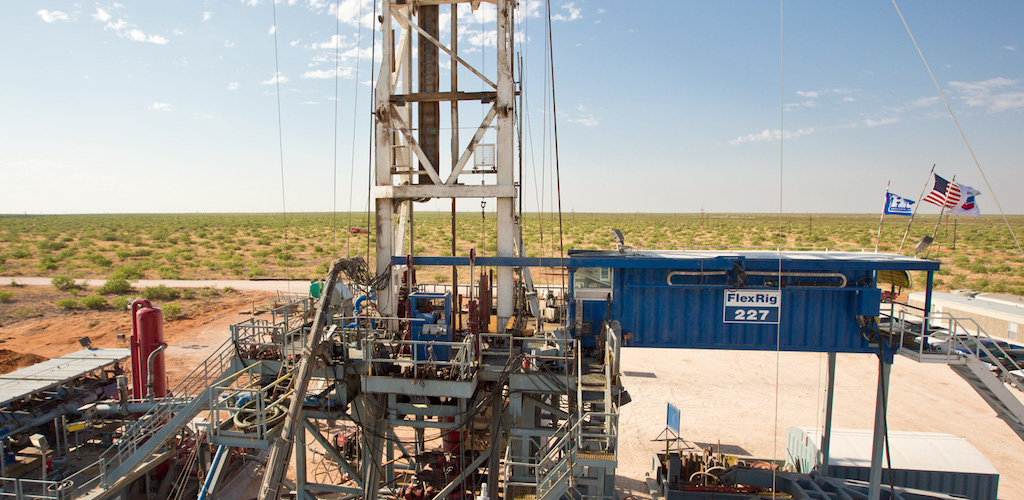

The number of oil and gas rigs operating in North America has fallen sharply, creating knock-on effects for the supply chain, according to the latest data from oilfield services provider Baker Hughes.

The figures show that the North American rotary rig count fell to 491 for the week ended April 24, down by more thn half compared to the year previous when it stood at 1,054. The land rig segment has been particularly hard hit, accounting for all the fall, while offshore rigs in the Gulf of Mexico maintained operation.

The data was published as part of Baker Hughes’ rig count and showed that the total number of U.S. rigs was 1,021 for April, an increase of eight on the previous month and up 151 from the same time last year. Canada reported a decline of eight rigs to just 85 for April

Oilfield Service Reduced

Demand destruction from the Covid-19 pandemic is expected to surpass 20 million barrels per day over the next two months, and even when demand starts to pick up the glut of oil in storage is likely to dampen prices for the foreseeable future.

“Oil prices are … expected to remain low over the next two years. The current market uncertainty stemming from the low-oil price environment, combined with the logistical challenges of the coronavirus containment measures, have already started to hurt the oilfield service industry,” analysts at energy consultancy Rystad said.

Rystad forecasts total cost compression in 2020 to reach 12 percent, with 9 percent relating to service prices and the remaining 3 percent to efficiency improvements, but notes that “there is little room” for further cost compression given recent cost saving measures across the industry.

Texas Halves Rig Count

The U.S. shale gas industry has been decimated by the recent fall in oil prices. From an average of abou US$60 per barrel at the start of the year, oil prices are now well below US$30 per barrel making much shale gas production unprofitable.

Texas has been among the worst hit states due to the scale of the shale gas industry and the giant Permian Basin. Data from Baker Hughes shows that the Texas rig count has fallen from 491 a year ago to just 231in April.

The U.S. oil and gas sector is forecast to face significant losses, as many onshore shale gas projects remain fundamentally unprofitable unless significantly higher prices are attained.

Subscribe to BreakbulkONE and receive more industry stories and updates around impact of COVID-19.